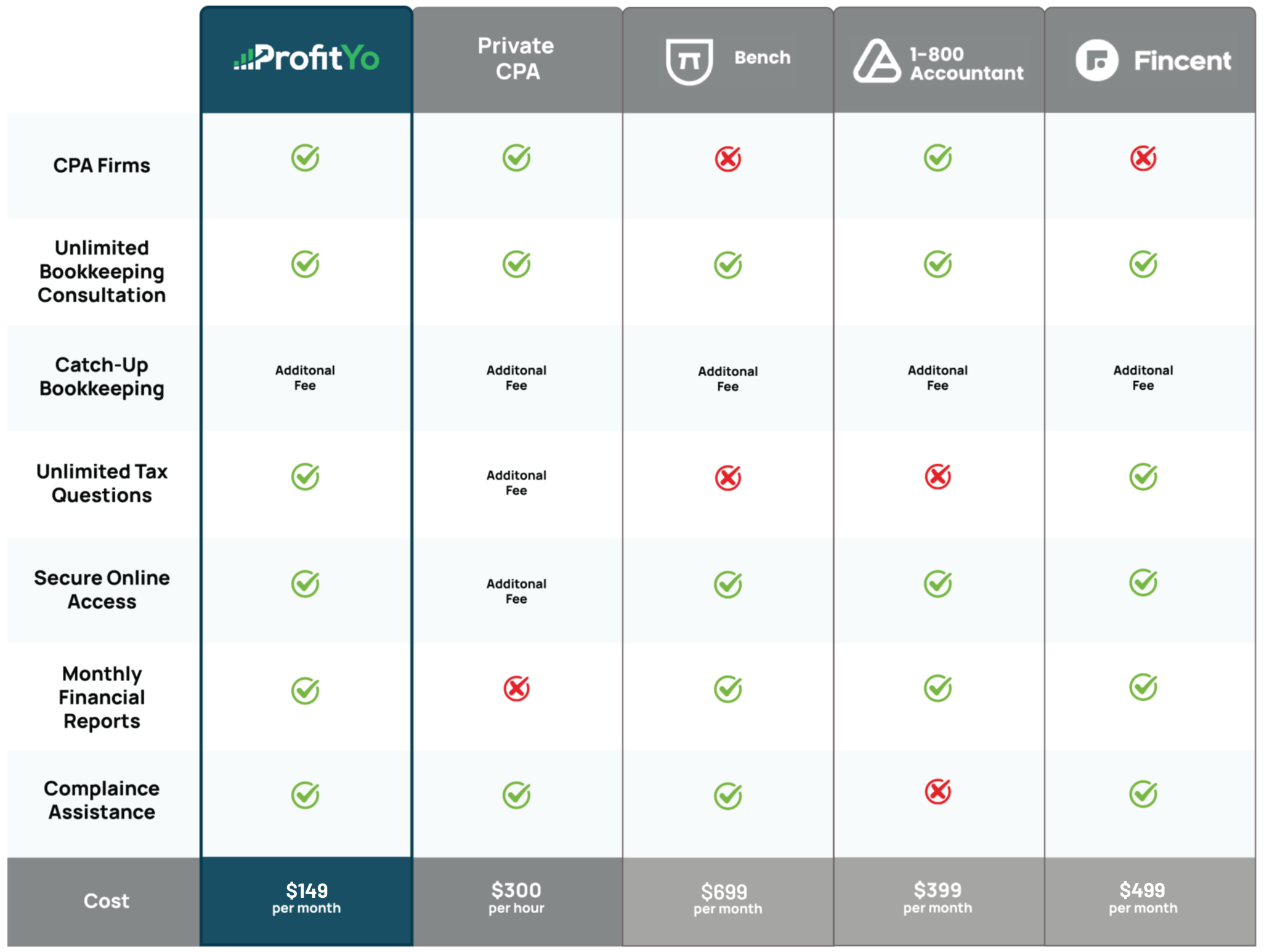

Tax Filing & Monthly Bookkeeping

Simple. Straight forward. No Hidden Fees.

Add Additional Services to Any Plan — Hassle-Free

“Let ProfitYo Take Care of Your Finances,

While You Focus on Growing Your Business.”

Frequently Asked Questions

Trusted by Small Business Owners

We’re committed to delivering outstanding customer service—every step of the way.

“Extremely prompt, knowledgeable, and responsive. I was a little worried in the beginning about bridging the geographic divide, but we had great communication. Will be working with them again” – Tax Tinger

“Great work, and asked all the right questions to help get my books back in order.

I am looking forward to working with her moving forward to

keep my books in shape.” — Patricklessor

“Rachel and her staff were very efficient and straightforward to deal with. They asked good questions and did a great job following up via text or phone for the urgent times I needed them.” — Gooser2007

“I had a great experience with Rachel and her team.

Very clear directions and quick turnaround. I will continue my bookkeeping

with their service” — Owen53

“Rachel is highly knowledgeable and professional. She addressed all my inquiries about my business’s accounting in the U.S. and provided me with

valuable tips and guidance,” — almgandre

“Rachel and the team did a great job helping to balance our books and strategize on filing some pending tax returns. They provided a customized service that was tailored to my specific need in a sensitive situation,” — himalayastudios

“Clear communication and reliable. She helped me reasonably solve a time-sensitive issue. She answered all my questions and was responsive when we were close to the deadline. Thanks Rachel and team!” — docdigital